Mortgage calculatorDown payment calculatorHow Considerably house am i able to afford calculatorClosing charges calculatorCost of dwelling calculatorMortgage amortization calculatorRefinance calculator

In this instance, the main difference in desire expenses isn’t incredibly substantial. Nonetheless, the contrast may very well be higher if you owe a bigger loan amount or have a higher interest rate.

The Rule of seventy eight is often a means of computing curiosity payments on installment loans made while in the 1930s that may be now largely out of favor.

When repaying a loan, the payments encompass two sections: the principal as well as curiosity. The rule of 78 assigns more interest to your early payments than an easy curiosity method. Should the loan is not compensated off early, the full curiosity paid out working with very simple desire along with the rule of 78 will be the similar.

The Forbes Advisor editorial team is independent and aim. To help help our reporting perform, and to continue our power to deliver this written content without spending a dime to our visitors, we obtain payment from the companies that publicize within the Forbes Advisor web site. This payment comes from two most important resources. To start with, we offer compensated placements to advertisers to present their features. The compensation we acquire for people placements impacts how and exactly where advertisers’ offers show up on the location. This web site does not include things like all firms or solutions readily available inside the industry. Next, we also consist of inbound links to advertisers’ gives in some of our content; these “affiliate back links” may possibly create profits for our web-site after you click on them.

Quite a few or all the merchandise highlighted here are from our companions who compensate us. This might affect which solutions we compose about and in which And the way the merchandise appears over a web site.

But When your loan more info is for any shorter expression (personal loans could be) or you intend to repay it early, it’s crucial to understand how your desire is calculated — making use of both the simple fascination or precalculated process.

Borrowers should cautiously evaluate the desire calculation process employed of their loans and its implications for their repayment system.

In accordance with the Rule of 78, each month in a borrower’s deal is assigned a price. This price is precisely the reverse of its occurrence while in the agreement.

While you pay off your loan and the principal decreases, so does the desire you owe. Lots of loan kinds use this technique, such as most mortgages, auto loans and personal loans.

Though There are a selection of reasons why automobile customers may possibly run into extra money (ex. family members loans, finishing payments on other huge payments, shifting and getting reduce hire or property finance loan rates), lenders nonetheless depend on that fascination. Automobile refinancing could be the only other option.

When lenders problem loans, they’re relying on the earnings they make by charging you curiosity. When you fork out back your loan they have got to go problem A further loan and cost a new borrower interest for making up for it.

But, lenders that also utilize the Rule of seventy eight need to make as much funds from funding your loan as lawfully probable — this may be especially true when you land a small desire price.

This may be disadvantageous for borrowers who wish to repay the loan early, as they will shell out a larger part of the whole desire fees previously than if they had experienced a standard loan.

Andrew Keegan Then & Now!

Andrew Keegan Then & Now! Susan Dey Then & Now!

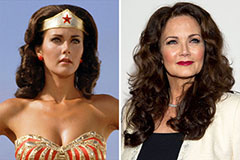

Susan Dey Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now! Andrew McCarthy Then & Now!

Andrew McCarthy Then & Now! Sarah Michelle Gellar Then & Now!

Sarah Michelle Gellar Then & Now!